Medical beauty business trend

Date: 2021-11-29 Categories: Industry News Hits: 1409 From: CharmyLady Tech., (Guangzhou), Co., Ltd

"Spend tomorrow's money to beautify today's face" and "beautify in installments". These medical aesthetic loan slogans once made consumers' hearts move.

In recent years, as the medical beauty industry has shown a fiery development trend, medical beauty loans have also emerged as the times require. Due to a large number of participants in medical beauty loans, disputes and regulatory concerns have often arisen.

In the context of a stricter supervision of medical loans, compliance issues have become a key concern of all parties. A few days ago, Xinyang, a leading medical beauty company, obtained the online micro-loan license through the acquisition of related companies, which also caused an endless stream of disputes about the future business direction of Xinyang.

In fact, there are not many companies currently engaged in the medical beauty loan business. It is understood that many well-known platforms including Baidu Youqianhua, Meituan, Dianping, and other well-known platforms have also launched Yimei installment products. In addition, licensed consumer finance companies such as Instant Installment and Home Credit Consumer Finance have also launched medical beauty loan products.

Customer service of a beauty salon told reporters that in-store consumption of 3,000 yuan can be used for installment, and various forms such as ant flower chanting, borrowing chanting, particle loan, and full-scale full-time period can be selected.

Although the medical beauty loan has provided a solution to the financial problems of a large number of consumers, the subsequent problems and disputes have also emerged one after another. According to statistics from the China Consumers Association, in the first half of 2021, the National Consumers Association received 16,459 complaints about beauty and hairdressing, an increase of 6189 over the same period last year, an increase of 60.26% over the same period last year, and the number of complaints ranked fifth in-service complaints. One of the important issues mentioned is to induce consumers to apply for beauty online loans, disputes occur, and the cost of protecting rights is high.

Xiaoyu, a practitioner of a consumer finance company, told reporters that third-party institutions are involved in medical aesthetics staging and education staging. For example, the company gives money to medical aesthetics institutions or educational institutions, and the institution provides services to customers, and the customers repay the company on a monthly basis. payment. "But if the medical and aesthetic institutions or educational institutions ran away or went bankrupt, and the customer service was gone, and the money had to be paid back, the customers would definitely be unwilling, and disputes would arise."

In addition, phenomena such as induced borrowing, opaque fees, high-interest rates, high handling fees, and violent collections are also common in the industry. Related complaints are also common on the black cat complaint platform. There are more than two hundred complaints about “medical beauty loan” and “medical beauty installment” on the platform. "Usary loans", "threat and intimidation form collection", "arrears have been paid off but the credit investigation is still overdue" and so on. In addition to some small loan companies, the object of the complaint also involves some well-known financial institutions, such as Guangdong Nanyue Bank and Home Credit Consumer Finance.

The China Consumers Association stated that consumers should carefully choose beauty online loans, rationally assess risks, recognize their own economic conditions and repayment capabilities, and do not pretend to be operated by others when signing online loan contracts.

Tighter policies

With the increasing frequency of disputes related to medical beauty loans, the rectification of the chaos surrounding medical beauty loans has also begun. In November 2019, the Shanghai branch of the People's Bank of China mentioned the "routine loan" in the medical aesthetics scene, and required strict rectification from the bank's capital side, and careful selection of business development models.

Since the beginning of this year, the supervision of medical loans has become more stringent. In May 2021, the National Health Commission, in conjunction with the Central Cyberspace Administration of China, the Ministry of Public Security and other departments, issued the "Special Rectification Work Plan for Combating Illegal Medical Beauty Services", and decided to jointly carry out the rectification of illegal medical beauty services from June to December 2021. Later in June, the China Internet Finance Association also issued the "Initiatives on Regulating Financial Products and Financial Services Related to Medical Beauty", calling for industry compliance.

In addition, the Shanghai Stock Exchange and the Shenzhen Stock Exchange also issued notices in August, requiring newly listed consumer financial asset securitization products (ABS) to prohibit assets related to "medical beauty consumer finance" from entering the pool, but issued ABS products will not be affected.

Under the influence of strong supervision and internal operating problems, leading institutions have withdrawn from the medical aesthetic installment market one after another. Around 2019, Mavericks installment, free buy, and US installments all left the medical beauty installment market for various reasons, and Qiao Rong Financial Services, as a well-known medical beauty installment player, directly announced its dissolution. The medical beauty installment giant Home Credit Consumer Finance also announced in 2020 that its medical beauty installment business has been frozen. According to relevant media reports, Home Credit Consumer Finance has now withdrawn from the medical beauty installment market.

"Of course, the medical beauty loan business starts quickly, and there are third-party agencies helping to do it, and there is no need to lend customers one by one," Xiaoyu told reporters that because it uses the scene consumption of a third-party agency, in case a third party If there is a problem with the institution, the customer will definitely have a dispute with the company that provides the loan if the customer cannot obtain the service. The final result is that the customer does not repay the company and the company's overdue rate increases.

Xiaoqi believes that although the medical aesthetics industry is still very hot, the uncertainty in the development of medical aesthetics loans is also relatively large. For various considerations, consumer finance agencies will not be involved in this field.

However, there are also voices that, as a major consumption scene in consumer finance, medical beauty loans still have good development prospects.

According to Zheshang Securities, in the context of policy tightening, high-quality compliance leading medical and aesthetic institutions can better resist the "cold winter." Bank of China Securities also believes that the current tightening of policy supervision and severe crackdowns on non-compliant and illegal medical beauty markets will benefit domestic leading companies.

According to iiMedia Consulting's data, China's medical beauty market will reach 311.5 billion yuan in 2023. With the overall boom in the medical aesthetics industry, but the increasingly stricter supervision, the future development of medical aesthetics staging is still in a fog. What is certain is that if you want to go longer, compliance issues are the top priority, which is why Xinyang spends money to buy licenses.

10 IN 1 Facial Care Hydria Machine

10 IN 1 Facial Care Hydria Machine  6 Function Heads First Generation Hydra H2O2 Hydrogen Oxygen RF Sprayer Face Beauty Machine

6 Function Heads First Generation Hydra H2O2 Hydrogen Oxygen RF Sprayer Face Beauty Machine  DR Facial Synthesizer

DR Facial Synthesizer  8-in-1 8 Function Heads Black Pearl Hydra Skin Beauty Apparatus

8-in-1 8 Function Heads Black Pearl Hydra Skin Beauty Apparatus  8in1 Hydra Facial Multi-function Beauty Machine

8in1 Hydra Facial Multi-function Beauty Machine  15in Screen 600W 808nm Hair Removal Machine

15in Screen 600W 808nm Hair Removal Machine  4 in 1 Elight +808nm Diode Laser+q Switched nd yag Laser +RF Multifunctional Beauty Machine

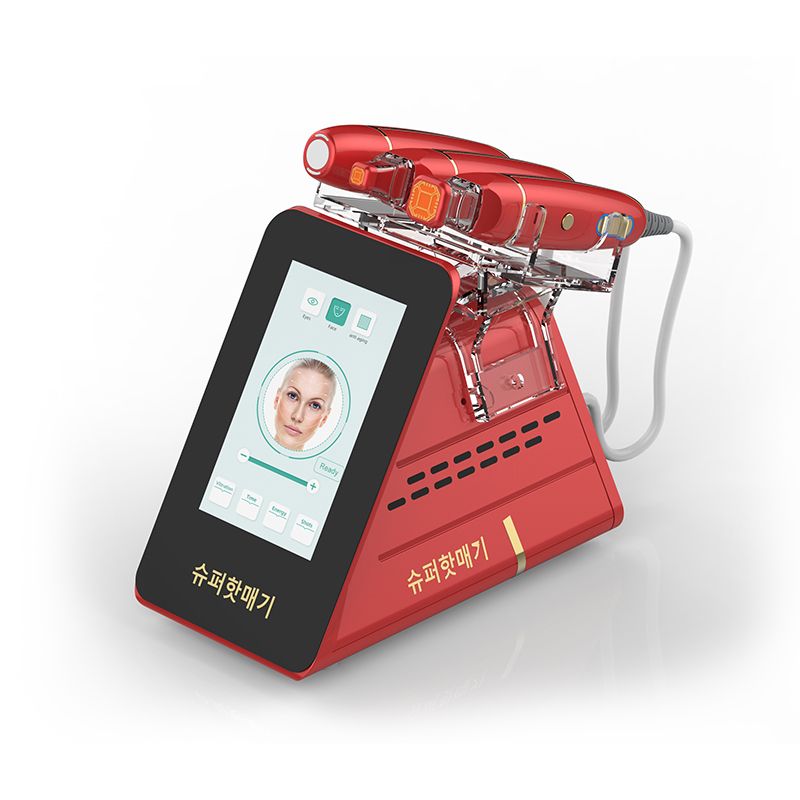

4 in 1 Elight +808nm Diode Laser+q Switched nd yag Laser +RF Multifunctional Beauty Machine  4 in 1 HIFU Thermagic Anti-aging Beauty Instrument

4 in 1 HIFU Thermagic Anti-aging Beauty Instrument  808 Diode Hair Removal Laser Machine

808 Diode Hair Removal Laser Machine  Double Screen 4 in 1 HIFU Multifunctional 360 Magneto Optical ND Yag Laser RF Beauty Machine

Double Screen 4 in 1 HIFU Multifunctional 360 Magneto Optical ND Yag Laser RF Beauty Machine  Rechargeable E6 Electric Nano Derma Pen

Rechargeable E6 Electric Nano Derma Pen  Charm 2in1 Plasma Beauty Machine

Charm 2in1 Plasma Beauty Machine  New 64 water soluble needle

New 64 water soluble needle  New 192 Microneedle Roller

New 192 Microneedle Roller  Titanium Needle Leather Roller Micro

Titanium Needle Leather Roller Micro  360 Degree Fat Freeze Cryolipolysis Slimming Machine

360 Degree Fat Freeze Cryolipolysis Slimming Machine  7D Lifting Apparatus

7D Lifting Apparatus  9 in1 Ultrasonic Laser Fat Exploding Apparatus

9 in1 Ultrasonic Laser Fat Exploding Apparatus  5 in 1 Portable Mini Fat Exploding Instrument

5 in 1 Portable Mini Fat Exploding Instrument  5 in 1 40k ultrasonic cavitation vacuum body slimming instrument

5 in 1 40k ultrasonic cavitation vacuum body slimming instrument  Seven Colors Spectrograph Cold and Warm SPA Skin Rejuvenation

Seven Colors Spectrograph Cold and Warm SPA Skin Rejuvenation  Seven Colors Spectrograph Cold and Warm SPA Skin Rejuvenation

Seven Colors Spectrograph Cold and Warm SPA Skin Rejuvenation  Household RF Lifting Machine (Level 6)

Household RF Lifting Machine (Level 6)  Household RF Lifting Machine (Level 4)

Household RF Lifting Machine (Level 4)  Household RF Lifting Machine (Level 3)

Household RF Lifting Machine (Level 3)  Kegel Exercise EMS Vainal Tightening Device

Kegel Exercise EMS Vainal Tightening Device  Breast Max Mutifunctional body Shape Care Vacuum Machine

Breast Max Mutifunctional body Shape Care Vacuum Machine  Nine-in-one Hydrogen and Oxygen Micro-Carving Instrument

Nine-in-one Hydrogen and Oxygen Micro-Carving Instrument  2 in 1 HIFU+Thermagic Anti-aging Beauty Instrument

2 in 1 HIFU+Thermagic Anti-aging Beauty Instrument  Carbon Gel For Laser Treatment Facial Nd Yag Cream Carbon

Carbon Gel For Laser Treatment Facial Nd Yag Cream Carbon  DR. CPU Serums

DR. CPU Serums  Serums of Hydra Facial Machine

Serums of Hydra Facial Machine